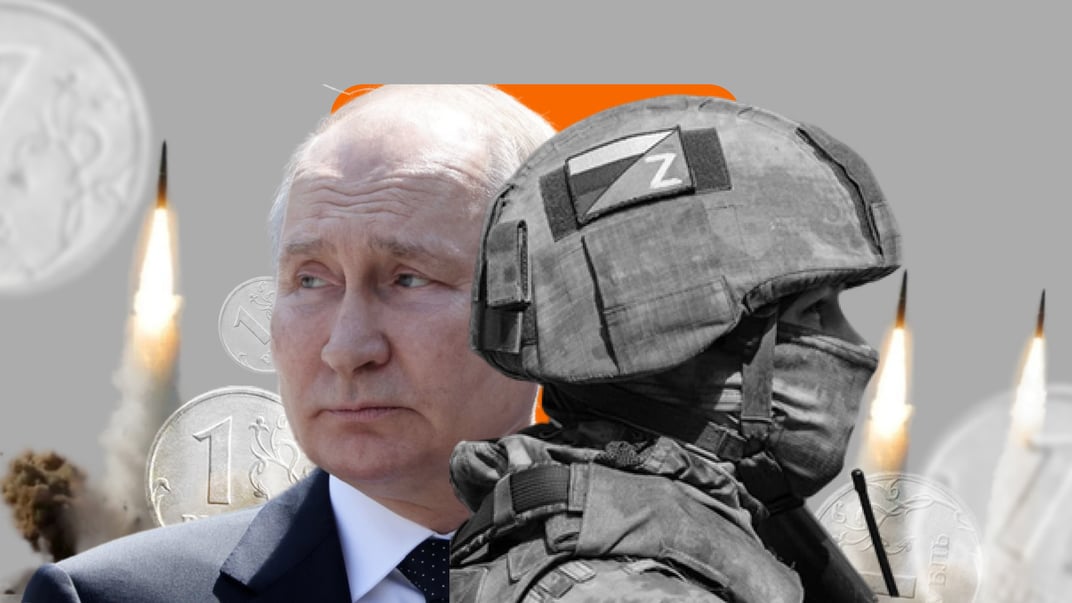

Putin's overheated economy: how much longer can Russia sustain its military efforts?

The Military Economy of Russia

In September, the head of Ukraine's Main Intelligence Directorate, Kyrylo Budanov, stated that by the summer of 2025, significant economic issues would prompt the Kremlin to consider ending the war. Citing intelligence data, Budanov noted that Moscow is aiming to conclude the war with a victory before 2026 due to unfavorable socio-political and financial-economic factors.

Today, Russia's economy resembles that of a sick patient. Instead of seeking treatment, funds are being spent to harm its neighbors. Military expenditures are rising, revenues are declining, and the budget deficit is increasing.

The draft federal budget of the Russian Federation for 2025 includes expenditures of 13.5 trillion rubles (approximately 143 billion dollars) for the "National Defense" category, which accounts for 6.3% of GDP. An additional 3.5 trillion rubles (around 37 billion dollars) of Russia's budget expenditures next year are earmarked for "National Security."

Overall, in 2025, 41% of the Russian budget will be allocated to "defense and security," which means funding for the war against Ukraine. This is a 25% increase compared to the current year. At the same time, the Russian budget project for the next three years does not anticipate an increase in oil and gas revenues, which make up the lion's share of the budget.

Due to disproportionately high military spending, the budget deficit has significantly increased. In 2024, it amounted to 3.3 trillion rubles (approximately 34 billion dollars). To continue its aggression against Ukraine, the Russian government is cutting social spending, healthcare, education, and science.

Ukraine is also spending substantial amounts on defense, reaching around 100 billion dollars annually. Half of this comes from its own budget, while the other half consists of weapons supplied by Western partners.

According to Swedish economist Anders Aslund, Ukraine could win the war if it had an additional 50 billion dollars a year and permission from Western partners to strike military targets within Russia using long-range weapons.

The West can provide the necessary amount by using the 300 billion dollars of frozen Russian sovereign assets. This money is critical for Ukraine's ability to resist the aggressor and restore its territorial integrity.Anders Aslund, Swedish economist

Back to the USSR

Currently, the military-industrial complex is the only sector of the Russian economy that is expanding. Such an imbalance leads to increased inflation rates and creates a "overheated economy" effect. To keep inflation under control, the Central Bank of Russia has raised interest rates twice this year. In July, from 16% to 18%, and in September, to 19%. For comparison, in Ukraine, the key interest rate is 13%.

Currently, the inflation rate in Russia stands at 9.1%, and, according to Anders Aslund, the real inflation in Russia is much higher. This was similarly observed in the Soviet Union, where authorities portrayed inflation as real economic growth, which in reality did not exist.

The Cumulative Effect of Sanctions

Hidden inflation in Russia also indicates that Western financial sanctions are much more effective than many observers believe. Russia has no ability to borrow money abroad and is forced to rely solely on tax revenues and reserves. Furthermore, half of Russia's foreign currency reserves are frozen in Western countries.

In 2021, the National Wealth Fund peaked at 183 billion dollars. As of March 2024, the liquid reserves of the Russian National Wealth Fund have shrunk to 55 billion dollars, or 2.8% of GDP. Most of these funds have already been invested and are not liquid, notes Anders Aslund.

With a GDP of 1.9 trillion dollars, Russia spends about 40 billion dollars a year to offset the budget deficit, meaning that the state reserves are expected to run out next year, Aslund predicts. Although Russia is increasing taxes on individuals and legal entities, this is unlikely to help in an environment of economic stagnation, and the Russian government cannot sell many bonds in the domestic market, according to the Swedish economist.

As the third anniversary of the aggressive war against Ukraine approaches, the financial, technological, and demographic obstacles faced by the Russian economy are more severe than commonly believed. Despite the Kremlin's attempts to convince the world that it is in control of the situation, time is not on Russia's side, notes Aslund.

Moreover, Russia continues to seek ways to circumvent Western sanctions by importing Western goods through Central Asian countries, Turkey, and China. Moscow is also managing to bypass restrictions on its oil trade, which is being delivered to China and India using a shadow fleet.

Vaccination of the Russian Economy

Despite the sanctions complicating life for the Kremlin, Russia is staying afloat thanks to economic cooperation with China, India, and Global South countries. Western sanctions could be more effective if they were imposed all at once rather than gradually, economic expert Alexander Parashiy noted in an interview with Hromadske.

If it were possible to completely isolate Russia, if no one bought their oil and supplied them with weapons and technology, then this story might end quickly. Unfortunately, sanctions are being introduced gradually, and therefore Russia quickly develops immunity to them. The gradual introduction of sanctions vaccinates the Russian economy.Alexander Parashiy, head of the analytical department of the Ukrainian investment company Concorde Capital

Despite the sanctions, the Russian military-industrial complex continues to ramp up production of drones and missiles, which contain many imported components. Moreover, 95% of all parts found in Russian weapons on the battlefield come from Western manufacturing countries that are providing military assistance to Ukraine, according to a report published last year by the Kyiv School of Economics and the International Working Group on Sanctions Against Russia.

The West should strengthen its export control, says Alexander Parashiy. Although loopholes allowing sanctions to be circumvented are being closed, new ones continue to emerge. However, it is becoming more challenging for Russia to obtain the desired goods.

Nevertheless, it would be unwise to expect that an economic collapse will destroy Russia or halt the war against Ukraine, a journalist commented.

Economic collapse and disintegration in Russia are possible, but the question arises — when? Everyone knew that the USSR's invasion of Afghanistan would lead to severe consequences. However, that war lasted nine years.

In 1988, the Soviet Union withdrew its troops from Afghanistan. However, after the war ended, the USSR lasted for another three years. Therefore, Ukraine should focus on security guarantees rather than the problems faced by the Russian economy.Vitaliy Portnikov, journalist

If Western support is not weakened, Vladimir Putin's calculations that Russia can win a war of attrition may prove to be misguided.